Details

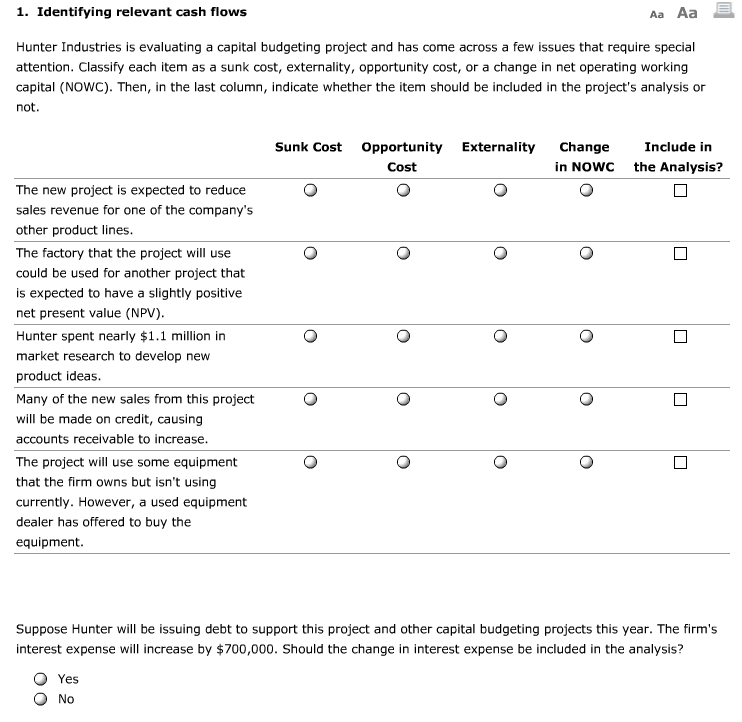

Hunter Industries is evaluating a capital budgeting project and has come across a few issues that require special attention. Classify each item as a sunk cost, externality, opportunity cost, or a change in net operating working capital (NOWC). Then, in the last column, indicate whether the item should be included in the project’s analysis or Suppose Hunter will be issuing debt to support this project and other capital budgeting projects this year. The firm’s interest expense will increase by $700,000. Should the change in interest expense be included in the analysis?

Reviews

There are no reviews yet.