Details

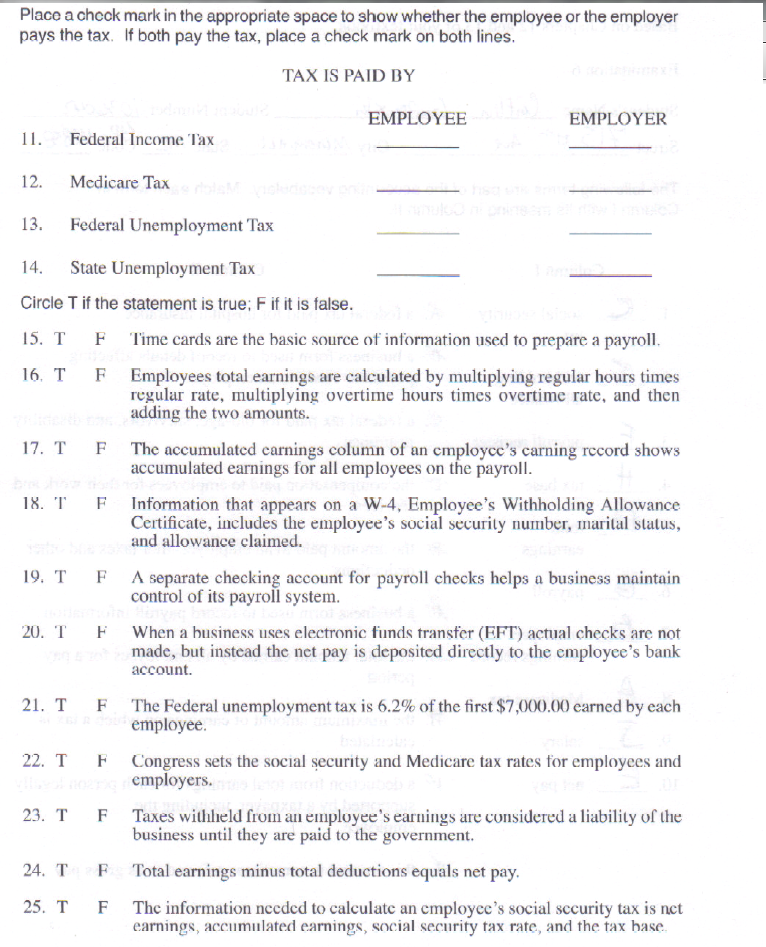

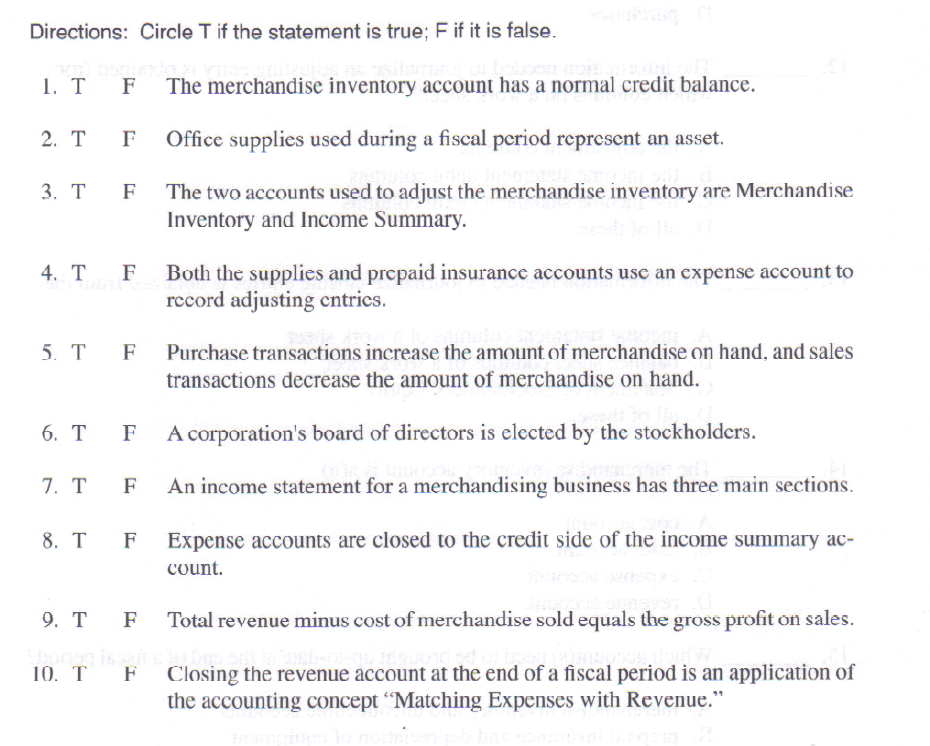

Place a check mark in the appropriate space to show whether the employee or the employer pays the tax If both pay the tax, place a check mark on both lines. Circle T if the statement is true; F if it is False. T F Time cards are the basic source of information used to prepare a payroll. T F Employees total earnings are calculated by multiplying regular hours times regular rate, multiplying overtime hours times overtime rate, and then adding the two amounts. T F The accumulated earnings column of un employee’s earning record shows accumulated earnings for all employees on the payroll. T F Information that appears on a W-4, Employee’s Withholding Allowance Certificate, includes the employee’s social security number, marital status, and allowance claimed. T F A separate checking account for payroll checks helps a business maintain control of its payroll system. 1 F When a business uses electronic funds transfer (F.FT) actual checks arc not made, but instead the net pay is deposited directly to the employee’s bank account. T F The Federal unemployment tax is 6.2% of the first $7,(KH).(K) earned by each employee. T b Congress sets the social security and Medicare tax rates for employees and employers. T F Taxes withheld from ail employee’s earnings arc considered a liability of the business until they are paid to the government. T F Total earnings minus total deductions equals net pay. T F The information needed to calculate an employee’s social security tax is net earnings, accumulated earnings, social security tax rate, and the tax base. Directions: Circle T if the statement is true; F if it is false. T F The merchandise inventory account has a normal credit balance. T F Office supplies used during a fiscal period represent an asset. T F The two accounts used to adjust the merchandise inventory are Merchandise Inventory and Income Summary. T F Both the supplies and prepaid insurance accounts use an expense account to record adjusting entries. T F Purchase, transactions increase the amount of merchandise on hand, and sales transactions decrease the amount of merchandise on hand. T F A corporation’s board of directors is elected by the stockholders. T F An income statement for a merchandising business has three main sections. T F Expense accounts are closed to the credit side of the income summary account. T F Total revenue minus cost of merchandise sold equals the gross profit on sales. T F Closing the revenue account at the end of a fiscal period is an application of the accounting concept “Matching Expenses with Revenue.”

Reviews

There are no reviews yet.