Details

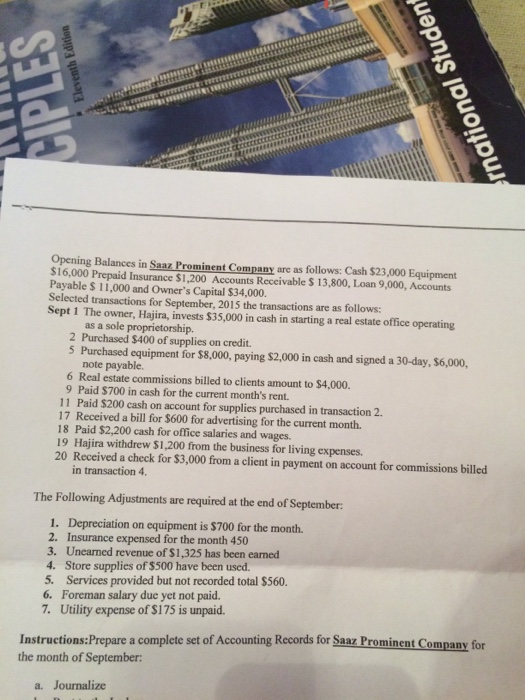

Cash $23,000 Equipment $16,000 Prepaid Insurance $1,200 Accounts Receivable $ 13,800,1-oan 9,000, Accounts Payable $ 11,000 and Owner’s Capital $34,000. Selected transactions for September. 2015 the transactions are as follows: The owner, Hajira, invests $35,000 in cash in starting a real estate office operating as a sole proprietorship. Purchased $400 of supplies on credit. Purchased equipment for $8,000, paying $2,000 in cash and signed a 30-day, $6,000, note payable. Real estate commissions billed to clients amount to $4,000. Paid $700 in cash for the current month’s rent. Paid $200 cash on account for supplies purchased in transaction 2. Received a bill for $600 for advertising for the current month. Paid $2,200 cash for office salaries and wages. Hajira withdrew $ 1.200 from the business for living expenses. Received a check for $3,000 from a client in payment on account for commissions billed in transaction 4. The Following Adjustments are required at the end of September: Depreciation on equipment is $700 for the month. Insurance expensed for the month 450 Unearned revenue of S1,325 has been earned Store supplies of $500 have been used. Services provided but not recorded total $560. Foreman salary due yet not paid. Utility expense of $175 is unpaid. Prepare a complete set of Accounting Records for Saaz Prominent C ompany for the month of September:

Reviews

There are no reviews yet.