Others

-

Zach Carey was a self-employed window…

$5.00Zach Carey was a self-employed window washer earning approximately $700 per week. One day, while cleaning windows on the 8th floor of the Second National Bank Building, he tripped and fell from the saffolding to the pavement below. He sustained severe multiple injuries but miraculously survived the accident. He was immediately rushed to the local hosptial for surgery. He remained there for 60 days of treatment, after which he was allowed to go home for futher recuperation. During is hospital stay, he incurred the following expenses: Surgeon: $2,500 Physician: $1,000 hosptial bill for room and board: $250 per day. nursing services: $1,200 anesthetics: $600 wheelchair rental: $100 ambulance: $150 drugs:$350 Zach has a major medical policy with Medical Benefits Corporation that has a $3,000 deductible clause, and 80% co-insurance clause, internal limits of $180 per day on hospital room and board, and $1,500 as a maximum sergical fee. The policy provides no disability income benefits.

1. Explain the policy provisions as they relate to deductibles, co-insurance- and internal limits.

2. How much should Zach recove from the insurance company? How much must he pay out of his own pocket?

3. Would any other policies have offered Zach additional protection? What about his inability to work while recovering from this injury?

4. Based on the information presented, how would you asses Zach’s health care insurance coverage? Explain.

-

Essay: Tranter, Inc., is considering a project

$10.00Essay

- Tranter, Inc., is considering a project that would have a ten-year life and would require a $1,500,000 investment in equipment. At the end of ten years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows:

All of the above items, except for depreciation, represent cash flows. The company’s required rate of return is 12%.

Required:

(a.) Compute the project’s net present value.

(b.) Compute the project’s payback period.

(c.) Compute the project’s simple rate of return.

- Five years ago, the City of Paranoya spent $30,000 to purchase a computerized radar system called W.A.S.T.E. (Watching Aliens Sent To Earth). Recently, a sales rep from W.A.S.T.E. Radar Company told the city manager about a new and improved radar system that can be purchased for $50,000. The rep also told the manager that the company would give the city $10,000 in trade on the old system. The new system will last 10 years. The old system will also last that long but only if a $4,000 upgrade is done in 5 years. The manager assembled the following information to use in the decision as to which system is more desirable:

Required:

(a.) What is the City of Paranoya’s net present value for the decision described above? Use the total cost approach.

(b.) Should the City of Paranoya purchase the new system or keep the old system?

- The following data concern an investment project:

The working capital will be released for use elsewhere at the conclusion of the project.

Required:

Compute the project’s net present value.

- Five years ago, Joe Sarver purchased 600 shares of 9%, $100 par value preferred stock for $75 per share. Sarver received dividends on the stock each year for five years, and finally sold the stock for $90 per share. Instead of purchasing the preferred stock, Sarver could have invested the funds in a money market certificate yielding a 16% rate of return.

Required:

Determine whether or not the preferred stock provided at least the 16% rate of return that could have been received on the money market certificate.

- Big Blue Co. is considering three investment opportunities having cash flows as described below:

Project I would require an immediate cash outlay of $10,000 and would result in cash savings of $3,000 each year for 8 years.

Project II would require cash outlays of $3,000 per year and would provide a cash inflow of $30,000 at the end of 8 years.

Project III would require a cash outlay of $10,000 now and would provide a cash inflow of $30,000 eight years from now.

Required:

If Big Blue has a required rate of return of 14%, determine which, if any, of the three projects is acceptable. Use the NPV method.

- Axillar Beauty Products Corporation is considering the production of a new conditioning shampoo which will require the purchase of new mixing machinery. The machinery will cost $375,000, is expected to have a useful life of 10 years, and is expected to have a salvage value of $50,000 at the end of 10 years. The machinery will also need a $35,000 overhaul at the end of year 6. A $40,000 increase in working capital will be needed for this investment project. The working capital will be released at the end of the 10 years. The new shampoo is expected to generate net cash inflows of $85,000 per year for each of the 10 years. Axillar’s discount rate is 16%.

Required:

(a.) What is the net present value of this investment opportunity?

(b.) Based on your answer to (a) above, should Axillar go ahead with the new conditioning shampoo?

- Lajara Inc. has provided the following data concerning a proposed investment project:

The company uses a discount rate of 13%.

Required:

Compute the net present value of the project.

- Burba Inc. is considering investing in a project that would require an initial investment of $200,000. The life of the project would be 8 years. The annual net cash inflows from the project would be $60,000. The salvage value of the assets at the end of the project would be $30,000. The company uses a discount rate of 17%.

Required:

Compute the net present value of the project.

- Grossett Corporation has provided the following data concerning a proposed investment project:

The company uses a discount rate of 10%. The working capital would be released at the end of the project.

Required:

Compute the net present value of the project.

- Woolfolk Corporation is considering investing $210,000 in a project. The life of the project would be 9 years. The project would require additional working capital of $46,000, which would be released for use elsewhere at the end of the project. The annual net cash inflows would be $42,000. The salvage value of the assets used in the project would be $32,000. The company uses a discount rate of 17%.

Required:

Compute the net present value of the project.

- Swaggerty Company is considering purchasing a machine that would cost $462,000 and have a useful life of 7 years. The machine would reduce cash operating costs by $115,500 per year. The machine would have no salvage value.

Required:

(a.) Compute the payback period for the machine.

(b.) Compute the simple rate of return for the machine.

- Alesi Company is considering purchasing a machine that would cost $243,600 and have a useful life of 8 years. The machine would reduce cash operating costs by $76,125 per year. The machine would have a salvage value of $60,900 at the end of the project.

Required:

(a.) Compute the payback period for the machine.

(b.) Compute the simple rate of return for the machine.

- Yeung Corporation is considering the purchase of a machine that would cost $330,000 and would last for 6 years. At the end of 6 years, the machine would have a salvage value of $33,000. The machine would reduce labor and other costs by $86,000 per year. The company requires a minimum pretax return of 12% on all investment projects.

Required:

Determine the net present value of the project. Show your work!

- The management of Glasco Corporation is considering the purchase of a machine that would cost $270,000, would last for 8 years, and would have no salvage value. The machine would reduce labor and other costs by $63,000 per year. The company requires a minimum pretax return of 18% on all investment projects.

Required:

Determine the net present value of the project. Show your work!

- Lovan, Inc., is considering the purchase of a machine that would cost $450,000 and would last for 8 years, at the end of which, the machine would have a salvage value of $63,000. The machine would reduce labor and other costs by $76,000 per year. Additional working capital of $3,000 would be needed immediately, all of which would be recovered at the end of 8 years. The company requires a minimum pretax return of 8% on all investment projects.

Required:

Determine the net present value of the project. Show your work!

- Dimpson Corporation is considering the following three investment projects:

Required:

Rank the investment projects using the profitability index. Show your work!

- The management of Grayer Corporation is considering the following three investment projects:

The only cash outflows are the initial investments in the projects.

Required:

Rank the investment projects using the profitability index. Show your work!

- Flamio Corporation is considering a project that would require an initial investment of $210,000 and would last for 6 years. The incremental annual revenues and expenses for each of the 6 years would be as follows:

At the end of the project, the scrap value of the project’s assets would be $24,000.

Required:

Determine the payback period of the project. Show your work!

- The management of Sobus Corporation is considering a project that would require an initial investment of $458,000 and would last for 9 years. The annual net operating income from the project would be $58,000, including depreciation of $48,000. At the end of the project, the scrap value of the project’s assets would be $26,000.

Required:

Determine the payback period of the project. Show your work!

- Shiffler Corporation is contemplating purchasing equipment that would increase sales revenues by $246,000 per year and cash operating expenses by $133,000 per year. The equipment would cost $275,000 and have a 5 year life with no salvage value. The annual depreciation would be $55,000.

Required:

Determine the simple rate of return on the investment to the nearest tenth of a percent. Show your work!

- The management of Moya Corporation is investigating purchasing equipment that would cost $336,000 and have an 8 year life with no salvage value. The equipment would allow an expansion of capacity that would increase sales revenues by $288,000 per year and cash operating expenses by $164,000 per year.

Required:

Determine the simple rate of return on the investment to the nearest tenth of a percent. Show your work!

- Hinck Corporation is investigating automating a process by purchasing a new machine for $520,000 that would have an 8 year useful life and no salvage value. By automating the process, the company would save $134,000 per year in cash operating costs. The company’s current equipment would be sold for scrap now, yielding $22,000. The annual depreciation on the new machine would be $65,000.

Required:

Determine the simple rate of return on the investment to the nearest tenth of a percent. Show your work!

- The management of Kleppe Corporation is investigating automating a process by replacing old equipment by a new machine. The old equipment would be sold for scrap now for $19,000. The new machine would cost $180,000, would have a 9 year useful life, and would have no salvage value. By automating the process, the company would save $30,000 per year in cash operating costs.

Required:

Determine the simple rate of return on the investment to the nearest tenth of a percent. Show your work!

-

Dr. Massy, who specializes in internal medicine…

$3.00Dr. Massy, who specializes in internal medicine, wants to analyze his sales mix to find out how the time of his physician assistant, Consuela Ortiz, can be used to generate the highest operating income.

Ortiz sees patients in Dr. Massy’s office, consults with patients over the telephone, and conducts one daily weight-loss support group attended by up to 50 patients. Statistics for the three services are as follows:

……………………………… Office Visits……………… Phone Calls………………. Weight-Loss Support Group

Maximum number

of patient billings per day……. 20……………………….. 40……………………………… 50

Hours per billing………………. 25………………………. .10 ……………………………….1.0

Billing rate……………………….. $50 ……………………..$25…………………………….. $10

Variable costs………………… $25………………………… $12……………………………… $5Ortiz works seven hours a day.

1. Dr. Massy believes the ranking is incorrect. He knows that the daily 60-minute meeting of the weight-loss support group has 50 patients and should continue to be offered. If the new ranking for the services is (1) weight-loss support group, (2) phone calls, and (3) office visits, how much time should Ortiz spend on each service in a day? What would be the total contribution margin generated by Ortiz, assuming the weight-loss support group has the maximum number of patient billings?

-

Exercise 3-8 Danielle Manning, D.D.S Assignment

$2.00Exercise 3-8 Danielle Manning, D.D.S., opened a dental practice on January 1, 2012. During the first month of operations, the following transactions occurred.

1. Performed services for patients who had dental plan insurance. At January 31, $820 of such services was earned but not yet recorded.

2. Utility expenses incurred but not paid prior to January 31 totaled $603.

3. Purchased dental equipment on January 1 for $84,000, paying $22,700 in cash and signing a $61,300, 3-year note payable.

(a) The equipment depreciates $420 per month.

(b) Interest is $613 per month.

4. Purchased a one-year malpractice insurance policy on January 1 for $25,020.

5. Purchased $1,662 of dental supplies. On January 31, determined that $377 of supplies were on hand.

Prepare the adjusting entries on January 31. Account titles are: Accumulated Depreciation❝Equipment, Depreciation Expense, Service Revenue, Accounts Receivable, Insurance Expense, Interest Expense, Interest Payable, Prepaid Insurance, Supplies, Supplies Expense, Utilities Expense and Accounts Payable.

-

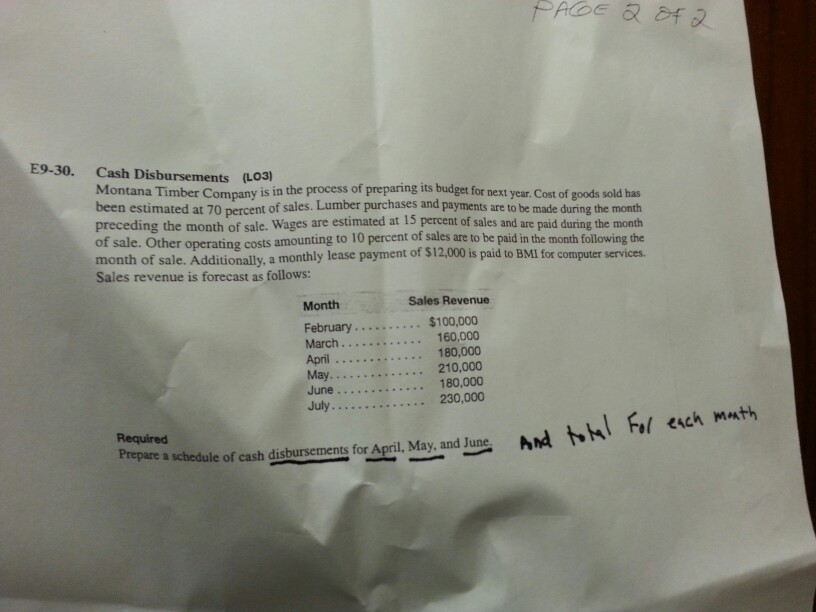

Montana Timber Company Case Study

$2.00Text: Montana Timber Company is in the process of preparing its budget For next year. Cost of rods sold has been estimated at 70 percent of sales. Lumber purchases and payments are to be made during the month preceding the month of sale. Wages are estimated at 15 percent of sales and are paid during the month of sale. Other operating costs amounting to 10 percent of sales are to be paid in the month following the month of sale. Additionally, a monthly lease payment of $12,000 is paid to BMI for computer services. Sales revenue is forecast as follows:

prepare a schedule of cash disbursements for April may and June and totals for each month

-

Spirit Company, a merchandiser, recently completed…

$2.50Spirit Company, a merchandiser, recently completed its 2010 calendar year. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. The company’s balance sheet and income statement follow:

A. What is the net cash flows provided (used) by investing activities?

B. What is the amount of dividends declared and distributed in 2010?

C. What is the net cash flows provided (used) by financing activities?

D. Determine the cash received by Spirit for the equipment sold in item C above.(It might mean B but not sure)

-

Similarity and difference between the impact of induced demand and imperfect information

$2.008. Discuss the similarity and difference between the impact of induced demand and imperfect information on the amount of medical care a physician prescribes for a patient. Give at least one example of evidence from class on the existence of induced demand.

-

Using the birthwt data set…

$1.00Using the birthwt data set, find the point estimate and the 90% confidence interval estimation for the population mean of the number of physicians visits (Variable name: “ftv”) during the first trimester.

Please include all R code

data can be downloaded from here: http://bit.ly/HoxbZ2

-

After a successful first year, Cam and Anna decide…

$1.00After a successful first year, Cam and Anna decide to expand Front Row Entertainment’s operations by becoming a venue operator as well as a tour promoter. A venue operator contracts with promoters to rent| the venue (which can range from amphitheaters to indoor arenas to nightclubs) for specific events on specific dates. In addition to receiving revenue from renting the venue, venue operators also provide services such as concessions, parking, security, and ushering services. By vertically integrating their business, Cam and Anna can reduce the expense that they pay to rent venues. In addition, they will generate additional revenue by providing services to other tour promoters. After a little investigation, Cam and Anna locate a small venue operator that owns The Chicago Music House, a small indoor arena with a rich history in the music industry. The current owner has experienced severe health issues and has let the arena fall into a state of disrepair. However, he would like the arena to be preserved and its musical legacy to continue. After a short negotiation, on January 1, 2014, Front Row purchases the venue by paying $10,000 in cash and signing a 15-year 10% note for $380,000. In addition, Front Row purchases the right to use the “Chicago Music House” name for $25,000 cash. During the month of January 2014, Front Row incurred the following expenditures as they renovated the arena and prepared it for the first major event scheduled for February. Jan. 5 Paid $21,530 to repair damage to the roof of the arena. Jan. 10 Paid $45,720 to remodel the stage area. Jan. 21 Purchased concessions equipment (e.g., popcorn poppers, soda machines) for $12,350. Renovations were completed on January 28, and the first concert was held in the arena on February 1. The arena is expected to have a useful life of 30 years and a residual value of $35,000. The concessions equipment will have a useful life of 5 years and a residual value of $250. Required: Prepare the journal entries to record the acquisition of the arena, the concessions equipment, and the trademark. Prepare the journal entries to record the expenditures made in January. If no entry is required, leave answer boxes blank. Expenditures related to operating assets should be capitalized. Compute and record the depreciation for 2014 (11 months) on the arena (use the straight-line method) and on the concessions equipment (use the double-declining-balance method). Round all answers to the nearest dollar. Straight-line depreciation allocates the depreciable cost over the useful life of the asset. Double-declining balance is an accelerated method of depreciation in which depreciation expense equals twice the straight-line rate multiplied times the asset’s book value. See Cornerstones 7-2 and 7-3. Would amortization expense be recorded for the trademark? Why or why not? The input in the box below will not be graded, but may be reviewed and considered by your instructor.