Business and Management

Showing 1432–1440 of 1826 resultsSorted by latest

-

Explain how treasurer can hedge the risk through Eurodollar futures contract

$5.00FRM interest rate future

4. A treasurer of an American company in March realizes that it needs to raise $25 million zero-coupon bond in August for a period of 6 months. Zero-coupon bond of similar quality is currently yielding 4%, a cost, which the treasurer finds acceptabl(e) The treasurer is of the view that interest rate will rise before the company will issue the debt, hence will increase the cost of debt. So to hedge the interest rate risk the treasurer decided to hedge the risk using September Eurodollar futures contract. September 90-day Eurodollar futures contracts are currently trading at 96.25.

You are required to

- a.Explain how treasurer can hedge the risk through Eurodollar futures contract? How many futures contracts are required to hedge?

- b.If the September futures contract in August closes either at 95.75 or 96.80, calculate the cost of the bond to the company in each case.

-

Finance Solutions

$15.00- Annuities:

You are saving for the college education of your two children. They are two years apart in age; one will begin college 15 years from today and the other will begin 17 years from today. You estimate your children’s college expenses to be $23,000 per year per child, payable at the beginning of each school year. The annual interest rate is 5.5 percent. How much money must you deposit in account each year to fund your children’s education? Your deposits begin one year from today. You will make your last deposit when your oldest child enters college. Assume four years of college

- Calculating Annuity Values:

Bilbo Baggins wants to save money to meet three objectives. First, he would like to be able to retire 30 years from now with retirement income of $25,000 per month for 20 years, with the first payment received 30 years and 1 month from now. Second, he would like to purchase a cabin in Rivendell in 10 years at an estimated cost of $350,000. Third, after he passes on at the end of the 20 years of withdrawals, he would like to leave an inheritance of $750,000 to his nephew Frodo. He can afford to save $2,100 per month for the next 10 years. If he can earn an 11 percent EAR before he retires and an 8 percent EAR after he retires, how much will he have to save each month in years 11 through 30?

- Valuing bonds:

Mallory Corporation has two different bonds, currently outstanding. Bond M has a face value of $20,000 and matures in twenty years. The bond makes no payments for the first six years, then pays $1,200 every 6 months over the subsequent eight years, and finally pays $1,500 every 6 months over the last years. Bond N also has a face value of $20,000 and a maturity of 20 years; it makes n coupon payments over the life of the bond. If the required return on both these bonds is 10% compounded semiannually, what is the current price of bond M? Of bond N?

- Non-constant growth:

Storico Co. just paid a dividend of aud 3.5 per share. The company will increase its dividend by 20% next year, and will then reduce its dividend growth rate by 5% per year, until it reaches the industry average of 5% industry average growth, after which the company will keep a constant growth rate forever. If the required return on Storico stock is 13%, what will a share of stock sell for today?

- Annuities:

-

Chapter 11 Solutions – Joseph Company

$5.00Joseph Company issued $800,000, 11%, 10-year bonds on December 31, 2007, for $730,000. Interest is payable semiannually on June 30 and December 31. Joseph Company uses the straight-line method to amortize bond premium or discount.

Instructions Prepare the journal entries to record the following.

- The issuance of the bonds. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3, 2.) The payment of interest and the discount amortization on June 30, 2008. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3,

- The payment of interest and the discount amortization on December 31, 2008. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3,

- The redemption of the bonds at maturity, assuming interest for the last interest period has been paid and recorded.

On May 1, 2008, Newby Corp. issued $600,000, 9%, 5-year bonds at face value. The bonds were dated May 1, 2008, and pay interest semiannually on May 1 and November 1. Financial statements are prepared annually on December 31. Prepare the journal entry to record the issuance of the bonds. Prepare the adjusting entry to record the accrual of interest on December 31, 2008. Show the balance sheet presentation on December 31, 2008. current liabiliteis, long term liablitities Prepare the journal entry to record payment of interest on May 1, 2009, assuming no accrual of interest from January 1, 2009, to May 1, 2009. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3, 2.) Prepare the journal entry to record payment of interest on November 1, 2009. Assume that on November 1, 2009, Newby calls the bonds at 102. Record the redemption of the bonds. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3, 2.)

-

Mini-Case: Cupcake Project Cash Flow

$15.00Mini-Case: Cupcake Project Cash Flow

Adapted from Chapter 11 Mini-Case in Foundations of Finance

Gammy is considering building a facility to manufacture cupcakes to distribute nationally. Your assignment involves both the calculation of cash flows associated with the new investment under consideration and the evaluation of several mutually exclusive projects. Grammy wants you to meet with everyone involved and write a meeting report for the board of directors that includes your recommendation. In addition to the recommendation, you have been asked to respond to a number of questions aimed at understanding the capital-budgeting process. Grammy wants to be sure that she and the board of directors understand cash flow and capital budgeting.

We are considering constructing a building to manufacture cupcakes. Currently we are in the 34 percent marginal tax bracket with a 15 percent required rate of return or cost of capital. This project is expected to last 5 years and then, because this is somewhat of a fad product, be terminated. The following information describes the project:

Cost of new plant and equipment $7,900,000 Shipping and installation costs $ 100,000 Unit Sales Year Units Sold 1 70,000

2 120,000

3 140,000

4 80,000

5 60,000

Sales price per unit $300/unit in years 1 through 4, $260/unit in year 5 Variable cost per unit $180/unit Annual fixed costs $200,000 per year in years 1 – 5 Working-capital requirements There will be an initial working-capital requirement of $100,000 just to get production started. For each year, the total investment in net working capital will be equal to 10 percent of the dollar value of sales for that year. Thus, the investment in working capital will increase during years 1 through 3, then decrease in year 4. Finally, all working capital is liquidated at the termination of the project at the end of year 5. The depreciation method Use the simplified straight-line method over 5 years. Assume the plant and equipment will have no salvage value after 5 years. - Read Chapter 11 of your textbook. As you read, consider how you will evaluate the Cupcake Project Cash Flow and what recommendation you will make to Grammy and the board.

- Download FIN 310 Foundations of Finance Chapter 11.ppt and review it to further your understanding of this chapter.

- Review the section of chapter 5 in Management Communications: A Case Study Approach related to meeting reports.

- Review Genesis 47: 18 – 19 and consider how it relates to this project. Feel free to supplement your application of biblical truth with other passages of scripture.

- Download and read the Mini-Case Cupcake Project Cash Flow and develop a meeting report that answers the following questions:

- Should you focus on cash flows or accounting profits in making the capital-budgeting decision? Should you be interested in incremental cash flows, incremental profits, total free cash flow, or total profits?

- How does depreciation affect free cash flow?

- How do sunk costs affect the determination of cash flows?

- What is the project’s initial outlay?

- What are the differential cash flows over the project’s life?

- What is the terminal cash flow?

- Draw a cash-flow diagram for this project.

- What is its net present value?

- What is its internal rate of return?

- Should the project be accepted? Why or why not?

- How does Genesis 47: 18 – 19 relate to this project and cash flow management?

- Your meeting report should:

- Answer the questions stated above.

- Focus on.

- What action is required?

- Who is responsible?

- What the timing will be.

3 Pages

APA 2 References

-

Red Bull Case Study

$15.00Red Bull Case Study

What is the critical thinking issue raised by the case?

Summarize the different types of marketing communications that Red Bull uses. Are theses “traditional” or “non-traditional”?

What communication goal does each of Red Bull’s marketing communication tools accomplish? Are you familiar with any additional brand touch points that aren’t mentioned in the case?

What is the risk of sponsoring a special event such as Felix Baumgartner’s historic dive?

Red Bull and other energy drinks have generated negative publicity regarding possible health hazards. Discuss

What makes Red Bull, in professor Kumar’s words, an “anti-brand brand”?

-

Don’t! The secret of self-control and Marshmallow experiment

$20.001. Read the following article:

Lehrer, J. (2009, May 18). Don’t! The secret of self-control. The New Yorker. Retrieved from: http://www.newyorker.com/reporting/2009/05/18/090518fa_fact_lehrer?currentPage=all

- Watch the following video: http://www.youtube.com/watch?v=7vObHeGF37U

This video is entitled “Marshmallow experiment”.

- Your reaction paper should contain a) a summary of the article and video, and b) a description of your personal reactions to the material. Papers should be approximately one and a half single-spaced pages in length, have one-inch margins, and use either the Calibri 12-point font or Times New Roman 12-point font (set for black ink). At least half of the paper should address your personal reactions to the assigned material. The content of the reaction paper is most important, but grammar/spelling errors will be penalized.

- Specifically, your reaction paper should:

- Have one section entitled “Summary” in which you provide a summary of the assigned materials. This section should be at least 1/2 page in length (single-spaced). Place an emphasis on summarizing the material in your own words. Use direct quotes only occasionally.

- Have one section entitled “Personal Reactions” in which you describe your personal reactions and opinions to the material (e.g., what you find to be important and/or significant about the material, areas of agreement and/or disagreement that you have with the material, ideas/thoughts that came to mind as you consider what was said, etc.). The “Personal Reactions” section of your paper should be at least as long as the “Summary” section, but should not exceed one page in length (single-spaced). Again, use direct quotes only occasionally.

5 Pages

-

Apple’s Corporate Audit

$60.00Contents (tables) of the paper include:

FIGURE 1: Porter’s value chain

FIGURE 2: Brand audit

FIGURE 3: Apple SWOT Analysis

FIGURE 4: Measuring Brand strength Interbrand

FIGURE 5: PESTLE Analysis for Apple and the Print Industry

FIGURE 6: Porter’s 5 Forces

FIGURE 7: Bownam’s Strategy Clock

FIGURE 8: Competitor Product Analysis

FIGURE 9: Competing e-book Product Features Analysis

Figure 10: Key advantages to digital vs print

FIGURE 11: Competitor Resource Analysis

FIGURE 12: Competitor Resource Diagram

FIGURE 13: Product portfolio analysisFIGURE 14: Product lifecycle

FIGURE 16: BCG Matrix

FIGURE 17: US Print & e-books sales ($b)

FIGURE 18: Market attractiveness

FIGURE 19: Sales per market; Growth per market territory

FIGURE 20: 12Cs Framework – Doole and Lowe – Print Industry

FIGURE 21: McKinsey’s 7

FIGURE 22: Shareholder value tube

FIGURE 23: Core competencies & Competitive Advantage

FIGURE 24: Financial Position -

Abbey Co. sold merchandise to Gomez Co.

$1.0021. Abbey Co. sold merchandise to Gomez Co. on account, $35,000, terms 2/15, net 45. The cost of the merchandise sold is $24,500. Abbey Co. issued a credit memo for $3,600 for merchandise returned that originally cost $1,700. Gomez Co. paid the invoice within the discount period. What is the amount of gross profit earned by Abbey Co. on the above transactions?

22.The following units of a particular item were available for sale during the year:

Beginning inventory 150 units @ $755

Sale 120 units @ $925

First purchase 400 units @ $785

Sale 200 units @ $925

Second purchase 300 units @ $805

Sale 290 units @ $925The firm uses the perpetual inventory system and there are 240 units of the item on hand at the end of the year. What is the total cost of ending inventory according to FIFO?

23.

a) The aging of Torme Designs shown below. Calculate the amount of each periodicity range that is deemed to be uncollectible.Est Uncollectible Accts

Age Interval: Balance: Percentage: Amount:

Not past due 850,000 3.50%

1~30 days past due: 47,500 5.00% 45,125

31~60 days past due: 21,750 10.00% 19,575

61~90 days past due: 11,250 20.00% 9,000

91~180 days past due: 5,065 30.00% 3,545.5

181~365 days past due: 2,500 50.00% 1,250

Over 365 days past due: 1,14595.00% 114.5

Total: 939,210b) If the Allowance for Doubtful Accounts has a credit balance of $1,135.00, record the adjusting entry for the bad debt expense for the year.

24. An employee earns $40 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. Assume that the employee worked 60 hours during the week, and that the gross pay prior to the current week totaled $58,000. Assume further that the social security tax rate was 7.0% (on earnings up to $100,000), the Medicare tax rate was 1.5%, and the federal income tax to be withheld was $614.

Required:

(1) Determine the gross pay for the week.

(2) Determine the net pay for the week.

-

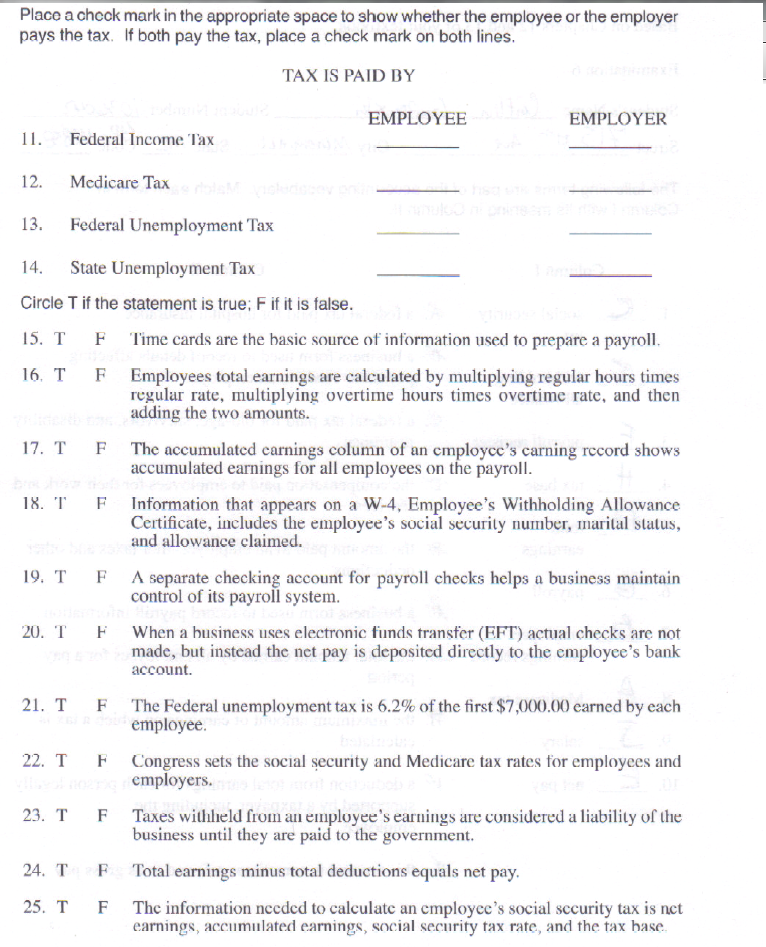

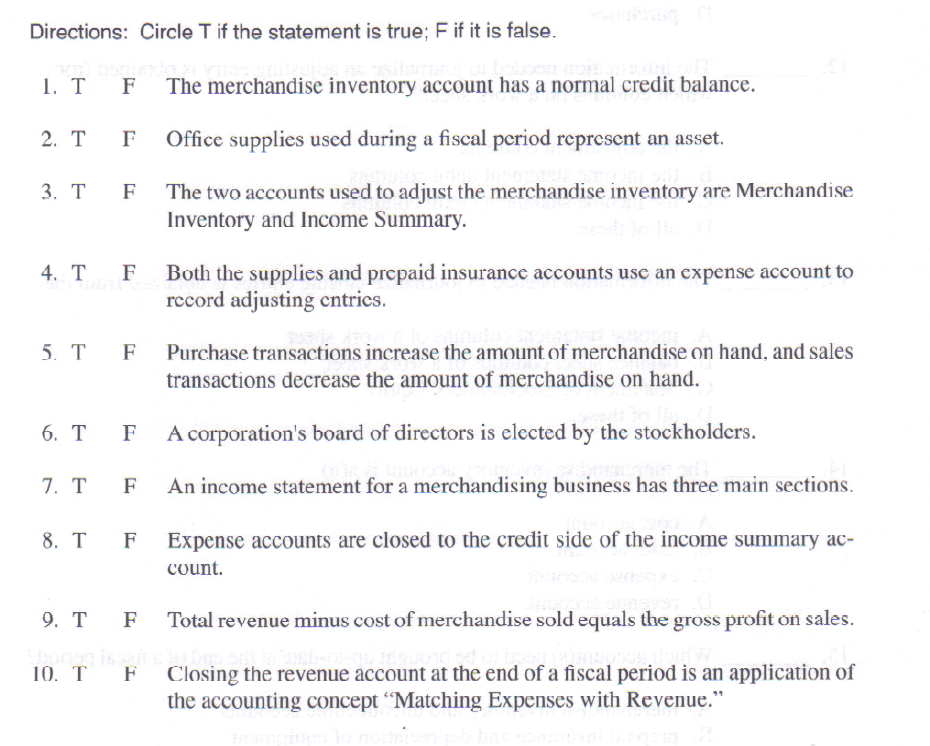

Place a check mark in the appropriate space to show whether the employee or the employer pays the tax

$5.00

Text: Place a check mark in the appropriate space to show whether the employee or the employer pays the tax If both pay the tax, place a check mark on both lines. Circle T if the statement is true; F if it is False. T F Time cards are the basic source of information used to prepare a payroll. T F Employees total earnings are calculated by multiplying regular hours times regular rate, multiplying overtime hours times overtime rate, and then adding the two amounts. T F The accumulated earnings column of un employee’s earning record shows accumulated earnings for all employees on the payroll. T F Information that appears on a W-4, Employee’s Withholding Allowance Certificate, includes the employee’s social security number, marital status, and allowance claimed. T F A separate checking account for payroll checks helps a business maintain control of its payroll system. 1 F When a business uses electronic funds transfer (F.FT) actual checks arc not made, but instead the net pay is deposited directly to the employee’s bank account. T F The Federal unemployment tax is 6.2% of the first $7,(KH).(K) earned by each employee. T b Congress sets the social security and Medicare tax rates for employees and employers. T F Taxes withheld from ail employee’s earnings arc considered a liability of the business until they are paid to the government. T F Total earnings minus total deductions equals net pay. T F The information needed to calculate an employee’s social security tax is net earnings, accumulated earnings, social security tax rate, and the tax base. Directions: Circle T if the statement is true; F if it is false. T F The merchandise inventory account has a normal credit balance. T F Office supplies used during a fiscal period represent an asset. T F The two accounts used to adjust the merchandise inventory are Merchandise Inventory and Income Summary. T F Both the supplies and prepaid insurance accounts use an expense account to record adjusting entries. T F Purchase, transactions increase the amount of merchandise on hand, and sales transactions decrease the amount of merchandise on hand. T F A corporation’s board of directors is elected by the stockholders. T F An income statement for a merchandising business has three main sections. T F Expense accounts are closed to the credit side of the income summary account. T F Total revenue minus cost of merchandise sold equals the gross profit on sales. T F Closing the revenue account at the end of a fiscal period is an application of the accounting concept “Matching Expenses with Revenue.”